When people think of Florida, they think of sunny South Florida, but they don’t realize that we actually have a hail season here. Hail storms often occur in the state – especially in Central Florida. Florida’s hail season tends to peak in May, but it typically lasts from March to July, with variations here and there depending on where in the state you are located.

What should I do after a hail storm?

As a public adjuster, this is a question I often get.

After a hail storm, the best thing to do is call a public adjuster – preferably one with experience handling cases like yours – to inspect your property. Public adjusters have specialized equipment to identify damage, even hidden damage that the naked eye cannot normally identify.

Having a public adjuster inspect your property will help you file a claim quickly in the event you do have damage. This will help you file within your window to do so, and having a public adjuster on your side can help you collect a higher and faster payout.

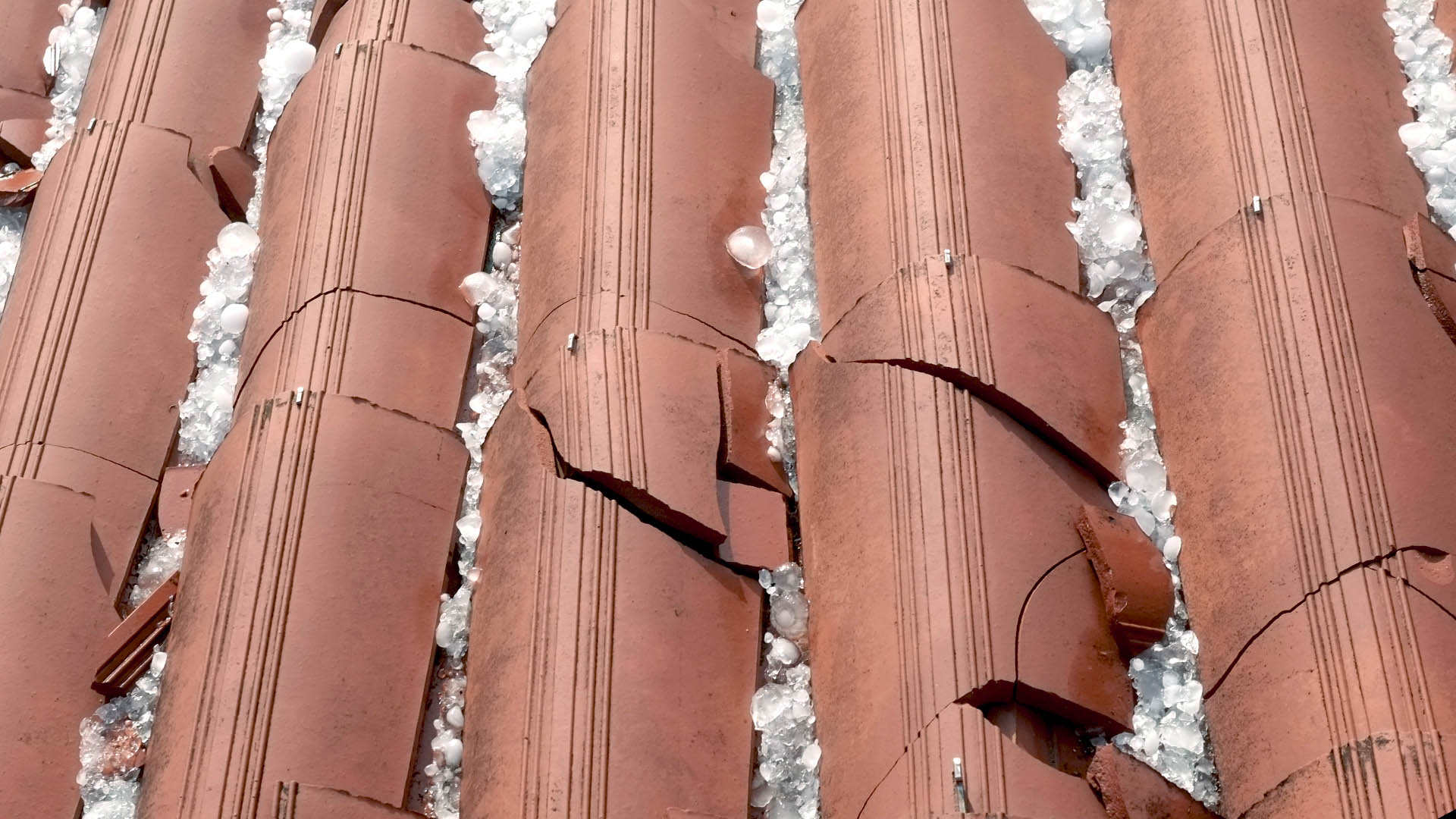

Hail damage can go unnoticed for months or more and can even lead to a roof leak.

A roof leak shortly after a hail storm is a typical result of damage your roof sustained during the storm. Another common consequence of a hail storm is tile roof damage. These claims can often be dragged out and last for months or more. Insurance companies are known to underpay and deny valid tile roof damage claims.

If you find yourself with property damage after a hail storm, then contact the public adjusters at Triumph Consulting. Our team’s 5-star reputation speaks for itself.

Insurance companies hate us because we get our clients paid.

Will my homeowner’s insurance pay for my hail damage?

If your policy names hail damage as a covered event, then you may receive a payout for your damages. Scheduling a free claim review with our team of public adjusters can help us better understand your policy and help us discover whether or not you are entitled to a payout from your insurance company.

Florida does not legally require your homeowner’s insurance company to include coverage for hail damage in your policy, but if your property has a mortgage, then there’s a high chance you do have coverage for hail damage since many lenders require it. If your policy does cover hail damage, then understanding if it covers the full cost of repairs or partial costs is the next step.

Hail damage claim public adjusters in Florida.

Triumph Consulting has been helping homeowners with their property damage claims since 2007.

Call 954-669-4935 now for a free claim review, or go to WeGetYouPaid.com.